Share the post "Top 5 Payment gateway integration for eCommerce mobile app"

Are you running an eCommerce business? Having a dedicated payment gateway for your e-commerce store serves to be a valuable tool necessary for your business to succeed. The payment gateway should be designed to deliver both securities as well as the overall ease of use to the end-users. It is estimated that by the end of 2020, around 2.1 billion online consumers will be making payments via secure payment gateway integration enabled by the leading eCommerce mobile apps.

With the advent of digital technology, payment gateways are becoming more popular amongst e-commerce stores of the world. It helps in offering a single, integration platform or solution for POS (Point of Sale) for processing the payments of the end consumers on an e-commerce portal.

To make sure that the merchants out there do not have to compromise with a single choice of payment gateway integration, the payment gateway solution that you choose should be secure enough towards eliminating the overall dangers of chargebacks. Moreover, it should also be capable of offering a wide scope of available choices for ensuring the payments. It should even offer additional features like excellent reporting, end-to-end customer support, focused expenses, and quicker settlement.

How do Payment Gateways Work?

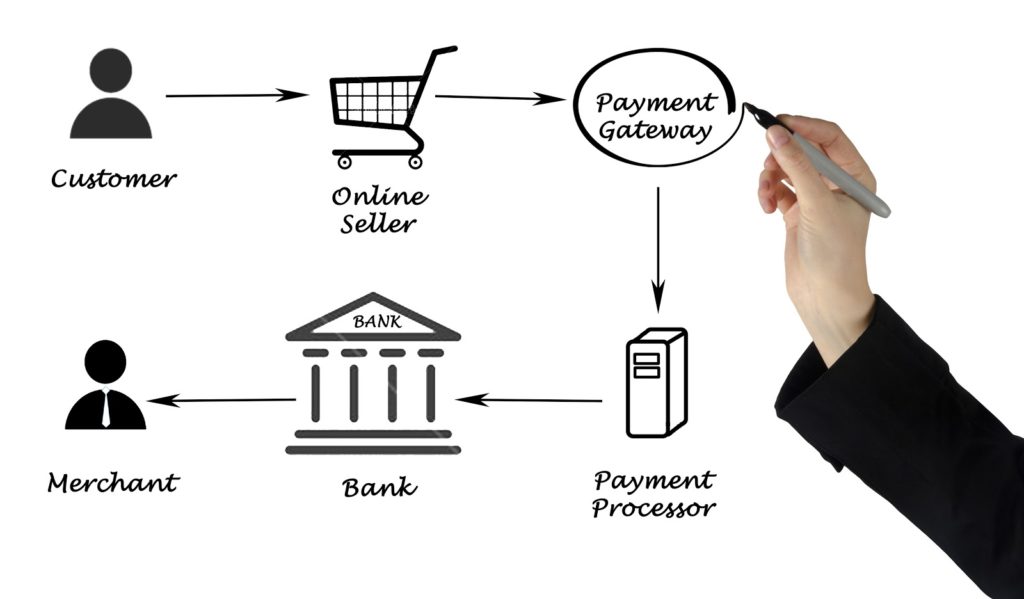

Payment gateways are introduced to any eCommerce mobile app for ensuring that the overall process of online payments is secure and seamless. Here are some of the vital steps that explain how payment gateways function for eCommerce stores :

- The gateway starts functioning as soon as an order is placed on the portal by an end customer by filling in the respective debit card or credit card credentials.

- The particular web browser is responsible for encoding the information that is being provided to transfer the same between the browser and the webserver of the particular merchant.

- Then, the payment gateway transmits the transactional data to the respective payment processor of the acquiring bank of the vendor

- The transaction information is sent to the card affiliation by the payment processor.

- The issuing bank of the credit card observes the given request for approval and has the right to either approve or reject the same.

- The processor would then extend an approval with respect to the customer and the merchant to the respective payment gateway

- As the gateway would obtain the given reaction, it would transmit the same to the interface for processing the payment.

- Once the transaction has been completed by the merchant, clearing transactions occur.

- The issuing bank would change the “auth-hold” status to that of the debit.

Factors to Consider While Choosing the Right Payment Gateway Integration

- Analyze the transition fee of the payment gateway

- Avoid gateways asking you to sign up repeatedly

- The gateway should offer multi-currency support

- Go through the terms & conditions of the provider to know what products are restricted

- The gateway should support multiple payment merchants

Read also:- Magento SMSCountry Extension to Send Order Details to Customers

The Best Payment Gateway Integration Platforms

- Authorize.net: When you are searching for the best online payment gateway platform for both large projects as well as small-scale businesses, Authorize.net is your one-stop solution. It is a leading platform that allows you to ensure payments for IT products, online purchases, website services, and so more.

Features :

- Automated billing

- Amazing user experience with respect to online payments

- Syncing with Quickbooks

- Improved security

- Stripe: Since its inception in 2010, Stripe has served to be one of the best payment services to e-commerce merchants. The gateway offers an abundance of innovative tools that set them apart from the other payment processing platforms. Stripe is available as a versatile and capable API while empowering you to personalize the given platform as per your unique requirements. The platform is known to feature a built-in productivity software solution accompanied by a set of open APIs for helping you to connect the same to the entire business ecosystem.

Features :

- Recurrent billing

- Discounts & trials

- Subscription setup

- Braintree: The payment gateway solution was introduced in the year 2012 and has served to one of the best payment gateways. The gateway is financed by leading investors and venture capitalists and features diversity in its programming capabilities. The platform is known to provide a safer checkout process to the online customers while allowing the e-commerce store owners to upgrade the respective order management.

Features :

- Excellent documentation

- Ease of setup

- Great APIs

- PayPal: Since its inception in 1999, PayPal is available for both credit card as well as MasterCard payments. The best thing is that it is available as a free platform for online shoppers. The merchants are required to pay some transition fees while using PayPal for Visa payments.

Features :

- Ease of use and setup

- Creating and sending invoices right through the account

- Recurring payments

- Amazon Pay: Amazon also extends its safe and streamlined payment service platform for online customers. Moreover, the platform charges nothing extra for its excellent services.

Features :

- Used for shopping A to Z items

- Cashback offering after every payment

Conclusion

While there are several options of lucrative payment gateways out there, you should choose the one that suits the requirements of your e-commerce business.